If you are late with the filing of tax returns, there is a possibility that someone else pretending to be you might receive the money. This is the hijacking of tax returns.

The tax industry is facing a stringent challenge in the form of tax return hijacks, as the number of such incidents are rising every year at a very steep rate. Citing the seriousness of the matter, even Intuit (owner of various tax and accounting software) had to come up with the decision of working with the states against the tax frauds[1]. They are yet to deliver any significant protection, but taxpayers can safeguard themselves by filing early. How?

To understand how filing tax earlier can save you from tax fraud let us first see how it works.

How Tax Hijacking Works?

Tax Hijacking is a result of identity theft. Scammers steal the personal details (such as- name, social security number, DOB, etc.) of the taxpayers and file returns on their behalf before the genuine taxpayers. By doing so, they are able to claim the returns on their prepaid card. They may even repeat the act for different taxpayers. Then, money and scammers flee.

If you are a victim of such fraud, you can get your money by proving that it was not you who took your money away. But it takes a good amount of energy and time to get there. Scammers in such cases, usually, remain untraced and may return next year with better preparation. So, the best way to stay safe is filing before the scammers.

How Filing Early Safeguards Against Tax Frauds?

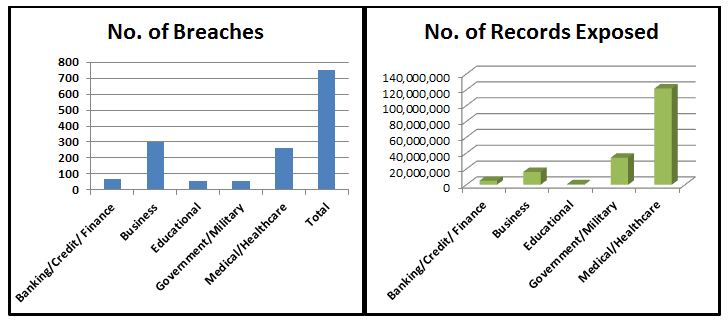

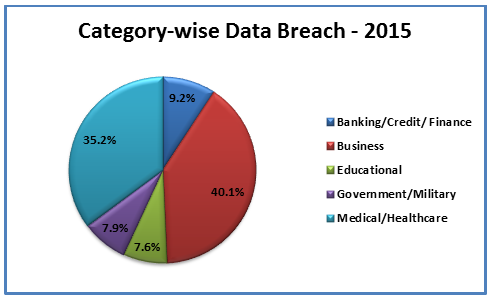

Such tax frauds are caused by the identity theft and data breach. With the immense popularity of data digitization, scammers have got a number of ways to reach the taxpayer’s details. Almost all types of data can be breached by an able scammer. As per the report by Identity Theft Resource Center[2], 750 breaches have occurred in the year 2015 to expose almost 177,837,053 records belonging to different categories.

The number of breaches in Business, Banking and Government categories (which may be holding the details required for tax filing) forms more than 55% of all the breaches.

Cybersecurity experts around the globe have been giving in strenuous efforts for protecting the data, but the ill-minds have regularly been able to pour through. What is more threatening is that data steal is not detected immediately. Studies claim that it takes 205 days on an average for a business to discover that their data has been breached[3]. So, by the time one would discover that a scammer has got the access to your details, their tax returns would have been claimed already.

Early filing of tax return remains the most dependable option for the taxpayers because once the genuine returns have been claimed, then scammers will not be able to do so. This is the reason why scammers are very active during the early tax season and as the season progresses, their operations go slower. Hence, safest way to go is going early.

Wrapping Up

The digital world is loaded with convenience. With the use of tax software, one can easily process the taxes in a quick and hassle-free manner. Add to it the potential of cloud and things get even better. In any case, data security has remained a serious concern.

Obviously, the digital world is secure now as compared to past few years but, there is still some space available for the attackers. One must follow the basic security practices, such as- using genuine software and keeping them updated, to stay on the safer side. To make it even better, being little quicker can immune you from any possible fraud.

References

[1] Identity Theft Resource Center | 2015 Data Breach Category Summary

[2] Bitglass Reports | Where’s Your Data?

Comments (1)

Good stuff Aditi! It is very important to understand the urgency in filing tax returns. Tax Hijacking is not something that should be taken lightly. The highly increasing rates of such incidents are very alarming. Individuals hoping for a return should make sure they are applying for the returns as soon as they can or they might find themselves at the short end of the tax return stick.

The Internet has made things quite easy these days. With just a little bit of diligence and carefulness a person can easily file his tax return forms early so that hijacking doesn’t becomes an important issue.

Cyber frauds are becoming a big issue in today’s world. While security measures are being help in place more often than not they fall short. The only thing someone can do to make sure that his tax returns are gonna be coming back to him is to ensure early and timely filing to the return forms.