Fraud detection and prevention are critical for any business, especially in the financial services industry. A study estimates that fraud costs organizations $600 billion each year, which is why it’s more important than ever to have leaders like NVIDIA working on solutions from the technology side of things.

As fraud becomes increasingly sophisticated and harder to detect, it’s crucial for businesses to implement AI-based fraud detection and prevention systems. Fraudsters are using increasingly complex methods to create fake identities, spread misinformation, and commit crimes. Banks have constantly been looking for a solution to help them detect fraudulent transactions. In an effort to find a suitable answer to this, many banks have recently begun to utilize GPU-accelerated artificial intelligence (AI) algorithms.

The growing volume and variety of transactions processed by banks, credit card companies, e-commerce providers, travel and logistics firms require more and more immediate decision-making to prevent losses, reduce risks, and fight fraud. This often-overwhelming data requires fast processing, which can deliver timely results that regular software cannot do due to several limitations. What comes in handy here is: GPU accelerated AI and cognitive computing to help create innovative ways of identifying and stopping questionable transactions.

Fraud prevention has become both a priority and an essential part of doing business in today’s fast-moving world. In this blog, we’ll explain how GPU-accelerated AI is helping in transaction monitoring & fraud detection by simplifying AI infrastructure and speeding up GPU for deep learning training times.

Traditional Methods are Obsolete and Deficient in the Digital World.

Fraud exists in an environment of very high transaction volume, sometimes in the billions a year. The amount of fraud is not correlated with these rapidly changing transaction volumes. Because it is difficult to do business while inhibiting legitimate activities and generating false positives, fraud detection becomes too expensive or slows down business. Therefore, traditional methods have been ineffective in detecting fraud. This is where machine learning technology can improve fraud detection and stop people from getting away with it.

Today, fraudsters operate at lightning speed, shifting their techniques to exploit loopholes in the verification processes of financial systems. As a result, several e-commerce operations are discussing the possibilities of artificial intelligence and machine learning in the battle against online fraud.

In the payments industry, fraud detection has always been the game changer. It is the perception of a certain percentage of fraudulent transactions where everything hinges upon. When dealing with large-scale data, the cost and time required to examine each transaction individually are enormous. This means that banks prefer to rely on probability calculations, which admittedly are not as precise but are significantly more efficient.

Fraud detection with AI is a multi-dimensional challenge requiring an ability to match events on multiple levels; these legacy approaches are inefficient. More importantly, traditional systems lack AI’s logic and reasoning capabilities.

A considerable amount of financial crime is committed via the misuse of legitimate systems. This type of fraud cannot be tracked back through current anti-money laundering processes and often goes undetected for a prolonged period. In order to reduce such fraud, these types of transactions should be monitored through identity intelligence practices such as:

– AI watch-listing,

– Entity analytics, and

– Customer behavior analytics.

Experience Lightning-fast Computing Power with Cloud-based GPU Resources

AI Drives Transaction Monitoring with Its Data-Driven Approach.

AI is a data-driven approach. It uses data to make decisions, which means that it can be used to detect fraud. For example, in transaction monitoring, machine learning models are used to analyze the transactions and detect if there are any suspicious patterns. If a fraudulent transaction is detected, then it will be flagged for investigation by the human team. Machine learning algorithms also use historical transaction data and user behavior patterns as features to train their models to be better at detecting fraudulent accounts (which may show up in the future).

As AI becomes ubiquitous, so will financial fraudsters. Building a financial AI solution doesn’t work with conventional commercial off-the-shelf tools. The proliferation of innovative products and devices to uncover money laundering activity drives demand for next-generation analytics. However, many financial organizations have a legacy infrastructure with CPU-based processing that cannot handle the processing speeds required for artificial intelligence (AI) analysis.

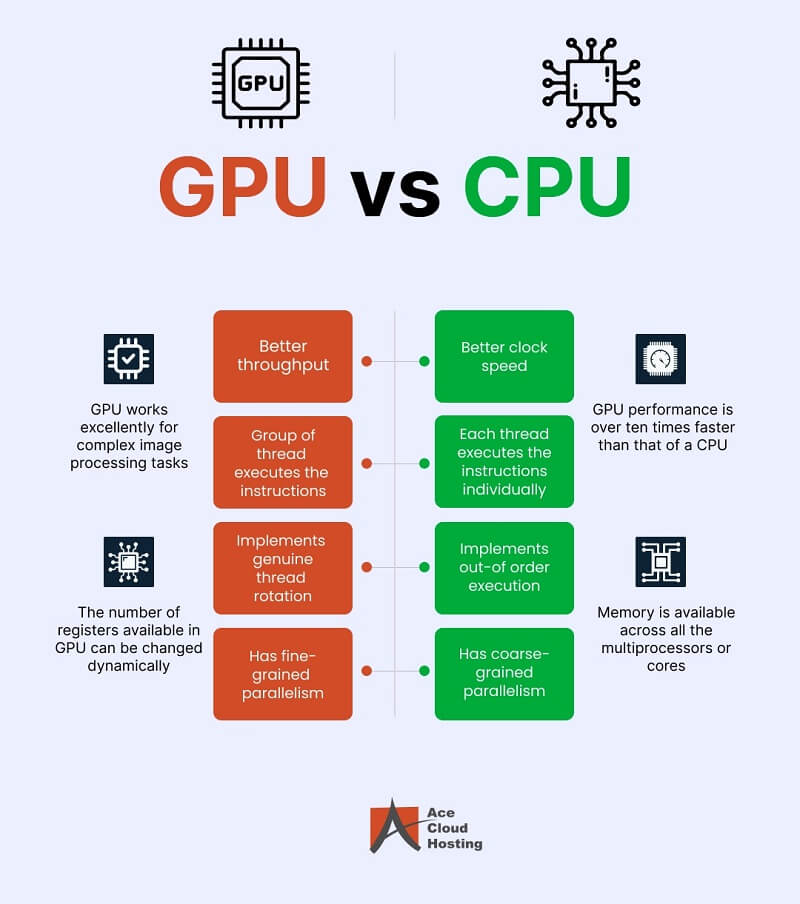

These organizations also have many privacy and regulatory obligations to uphold. This has led financial institutions to implement faster and more accurate transaction analysis methodologies and techniques. As the requirements for AI and associated ML features are implemented, CPU-based processing can no longer accommodate the speed required for training or actual inference of the ML models. Moving to a cloud-based GPU infrastructure provides improved processing speeds and allows predictive ML models to be trained or moved into production systems faster than a CPU architecture can handle.

Transaction Monitoring is Highly Effective in Detecting Fraud.

Transaction monitoring can be used as a real-time detection tool to automatically flag fraudulent transactions. It can also be used as a batch detection tool to perform post-processing on large volumes of transactions and detect any suspicious activities the system missed during the standard processing time frame.

It is also possible to use transaction monitoring in a hybrid mode – you can combine real-time and batch detection techniques within your existing architecture or deploy two different systems (one for real-time and one for batch). This will ensure that even if there are few false positives generated by one method, they can be discarded by another method and vice versa – thus increasing overall accuracy while reducing cost at the same time!

GPUs Help Simplify the AI infrastructure.

GPUs are easier to program and use. They are also more efficient than CPUs, faster in processing speed, cost-effective, and easily scalable. GPUs can be used for real-time fraud detection as they require less training time than traditional techniques using AI models. It is also easier to scale GPU-powered solutions compared to CPU based ones because of their parallel processing capabilities.

AI and machine learning are finding a home in the financial institution’s arsenal of anti-fraud tools. They work on the base premise that banks can identify fraud by learning typical customer behavior. By looking through vast amounts of data from past transactions, financial institutions can build and slot customers into several different profiles. A single account could be placed in hundreds of different profiles based on their activity, with the profile being updated in real-time after each transaction. When a transaction is made, AI analyzes it to see if it matches a pattern or deviates far enough from the standard to be detected.

A large number of data sources can help organizations detect fraudulent accounts, inappropriate payments, and money laundering. With GPU-accelerated cloud-based solutions, financial organizations can leverage Artificial Intelligence (AI) algorithms to accurately identify patterns in large data streams to find fraud, such as detecting subtle signs in the language and writing style of a loan application. This is routine, repetitive work that can be done faster by machine learning and deep learning algorithms executing on GPUs rather than CPUs.

Calculations done by GPU-accelerated SQL make it possible to discover fraudulent transactions while they happen rather than after they have been committed and have had a chance to grow into larger amounts.

The basic approach for transaction monitoring is simple: you take transactions on your AI system’s blacklist and check them against new transactions—mimicking the actions of fraudsters—to see which ones get through. It’s a lot of work: the number of possible transactions you need to check grows in proportion to your total transaction volume, and there are different kinds of transaction people want to mimic.

It has been seen that for such tasks, NVIDIA A100 GPU offer a better price-performance ratio when compared to their AMD counterparts. This is because NVIDIA GPUs have high memory bandwidth and a wide memory bus that allows them to access their memory chips quickly and efficiently. NVIDIA GPUs also have TensorRT acceleration library that provides an optimizer for deep learning interference. These features are coupled with a few more features, such as a runtime that offers low latency and throughput high enough for inference applications. These features boost the monitoring algorithms’ learning ability, which results accurately for near-perfect analysis of transaction fraud.

Supercharge Your Business Solutions with Ace Cloud GPU

Ace provides servers with resizable instances made primarily for AI and HPC workloads and best-in-class NVIDIA Ampere series GPUs. We have adaptable cloud solutions that make use of the top-tier GPU from NVIDIA.

Ace public cloud services are quite safe, with assured defense against DDoS assaults, and they offer round-the-clock customer assistance to handle all of your cloud-related problems. Rely on our global network of tier IV and tier V data centers, which are built, maintained and closely watched to fit your particular business demands. Get basic subscription plans, and various compute instances with a range of prices.

You may also like: