With business leaders realizing the potential cloud technology brings to the table, more and more are now keen on adopting cloud computing for their organizations. This realization has led to significant end-user spending on the cloud, with the figures already estimated to reach $397.5 billion in 2022.

Similarly, ATX Tax software users too can leverage the cloud to their benefit. With the cloud, they can overcome many shortcomings of a desktop-based ATX software system, such as limited accessibility, tedious IT responsibilities, and more.  Furthermore, they can also enjoy different perks, such as on-demand scalability as a service from a hosting provider.

Furthermore, they can also enjoy different perks, such as on-demand scalability as a service from a hosting provider.

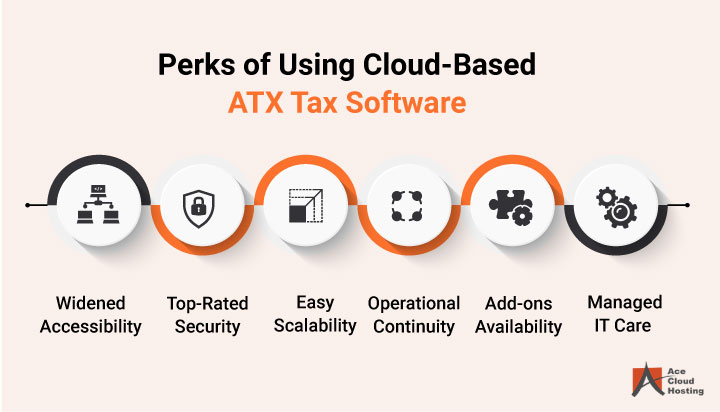

Here are several perks of ATX Tax Software Hosting:

1. Widened Accessibility

Like other cloud-hosted applications, hosted ATX software is accessible round the clock. It can be accessed from any device, anytime, via the Internet. Its accessibility differs from locally-installed ATX software, whose access is restricted to that one particular device.

Hosted ATX carries many benefits for organizations, empowering your employees to utilize their time better. They can quickly work while commuting or operate on a WFH basis.

Furthermore, they can use their smartphones to connect if you want to reach out to them urgently during a vacation.

2. Top-Rated Security

With time, hackers are becoming more active. Approximately 2224 occur each day, with a hacking attempt every 32 seconds, causing tax firms to invest in dependable security measures. An established hosting provider’s services bring quality security measures to your hosted ATX software.

Their multi-level security approach ensures your data remains safe. The features include the latest Intrusion Detection and Prevention system, modern antivirus software, bank-grade data encryption, and more. Furthermore, these features do not cost extra, letting you enjoy them without burning a hole in your pocket.

3. Easy Scalability

Tax season is the make-or-break period for any tax professional. Successfully cater to the service demands, and you can boost your revenue collection. Do the opposite, and your client base will wither away.

ATX Tax Software Hosting ensures you have adequate resources to manage your workload. They can help you scale up/down your IT resources to handle your fluctuating needs. You can get more RAM and storage for managing your tax operations during the tax season. Couple this with anytime, anywhere access to your hosted ATX Tax software, and you will never run out of resources for seasonal burden. Hence, you can scale down to utilize the resources as per your need when the tax season is over.

4. Operational Continuity

What is one thing that you cannot control and can cripple your operations? The answer is natural disasters or any such event. Take the example of the ongoing COVID crisis. At its peak, COVID-19 led to the permanent closure of over 100,000 small businesses in the U.S. Similarly, other disasters such as earthquakes, floods, or hurricanes severely affect businesses.

Hosted ATX Tax software from a reputed hosting provider offers reliable operational continuity. They offer multiple data centers spread across various geographical locations. Thus, the other is ready to provide continuous data accessibility even if one fails. Hosting providers also provide the latest anti-disaster measures such as advanced flood warnings, HVAC systems, etc.

5. Add-ons Availability

Most tax professionals like to integrate different add-ons to augment their ATX software performance. However, there is a limit to this number with locally-installed ATX software. With time, the more add-ons you integrate, the more your system slows down. However, ATX Tax software hosting is different. Renowned ATX hosting providers deploy High-Performance Computing (HPC) servers, ensuring sufficient resource allocation for each add-on without letting them slow down system performance.

Another perk of ATX Tax software hosting is access to a wide range of add-ons. For instance, you can integrate QuickBooks with ATX software for simpler tax calculation and filing.

6. Managed IT Care

How will you choose to manage a strenuous tax audit or run after your IT infrastructure? Being a tax professional is already too hard. You will surely not want to add another burden to your daily list.

Minimum IT management is one of the biggest perks of ATX Tax software hosting. From procurement to installation, everything is managed by your service provider. All you need is a thin-client device for accessing your ATX Tax software. Implement BYOD, and you will have almost zero IT responsibilities on your end.

In short, you can divert your attention to preparing tax reports and filing returns.

Conclusion

Complete backend IT management and round-the-clock access – are some of the widely-sought perks of hosted ATX tax software. On top of it, Ace Cloud Hosting offers a guaranteed 99.99% uptime.

So, if you are planning to adopt the cloud, don’t waste your time and click the chat button below!